|

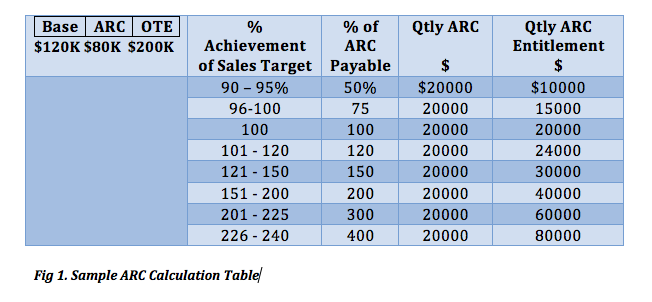

A question we are often asked by our clients is “What should the split be between the base salary and commission for our sales people?” The answer depends on a few variables, which we will explore in this article, but before we get to that, lets start with a few definitions; On Target/On Track Earnings. (OTE). This is the salary (usually expressed as an annual figure) that a Sales person can earn if they achieve 100% of their allocated sales target/quota. It is made up of two components; A Base Salary (BS) and an At Risk Component (ARC). Base Salary (BS) As the term implies is the amount paid to a Sales person before the payment of commissions. At Risk Component (ARC) Is the “incentive” component or commission paid to the Sales person for achievement of their targets/quotas. So named as this component of the salary package is “at risk” of not being paid if the targets are not met. OTE = BS + ARC When is the ARC paid? This depends upon each organisation but usually, commissions are paid on a periodic basis (usually quarterly against quarterly sales targets) as opposed to annually. Complex sales/sales with a longer sales cycle may be paid annually. The ARC can also kick in at some point before 100% of sales targets are achieved – i.e., at 90%. Some organisations also apply an “accelerator” after the achievement of 100% of target to further incentivise behaviour. The following table provides an example.  A further consideration is whether to retain some proportion of the quarterly ARC payment to be paid at year-end. The aim of which, is to incentivise consistent performance over the year and not just in one quarter. It is common practice to retain anywhere up to 25% of the quarterly payment, which is, then payable at year-end on achievement of the individual’s annual sales target. What should the split be between Base Salary and ARC? We call this split the Pay Mix. The Pay Mix is the ratio of Base Salary to ARC. In the previous example above we have used a 60/40 split of Base Salary to ARC. Where this ratio is set depends on a number of factors including;

The nature of the sales role In the example above we used a Pay Mix of 60/40 which would be common for a front line “hunter” sales role, often more directly responsible for signing new business; Business Development Manager/Business Development Director etc. The range here could be from 50/50 to 70/30. For “farmer” sales roles, e.g. Account manager, Account Executive who may carry smaller new business targets the Mix could range from 90/10 to 70/30. For Senior Sales Manager roles, e.g. Head Of Sales, Sales Director where delivery of targets is through teams, we may expect to see the Mix around 70/30 - 80/20. For these roles the larger % Base Salary can also attract higher quality candidates. The length of the sales cycle For organisations with a shorter sales cycle, we may expect a lower Mix as deals are being closed more regularly. For longer sales cycles, a higher Mix (i.e. higher Base Salary) can help keep the motivation levels high to stay with it. The complexity of the sale For complex project/process sales the Mix again will usually be higher in order to attract a candidate with the requisite skills and industry experience. Finally, The overall OTE should be set somewhere around 1/5 of the Sales Target. In other words the Sales person should be earning the company 5 x their OTE. What are the Pros and Cons of OTE? Pros:

Considerations

If you or your team need assistance with designing your organisation’s OTE plan, the Fifth Executive team has over 50 years combined Sales experience and can assist today. Call us on (02) 9258 1130 or visit our website at www.fifthexecutive.com.au  Congratulations ! You have successfully passed your initial interview with the Company and now they want you back for another round. As you successfully progress through these subsequent interview stages, you are likely to be interviewing with Managers who are higher up the food-chain and/or with Managers with a cross functional interest in the Sales team who are one or more steps removed from your day-to-day. It is important therefore, that you tailor your messages in these interviews accordingly, by addressing their higher order needs, and the specific issues that could be keeping them awake at night. For those of us that are familiar with the work of Robert Miller and Stephen Heiman (MillerHeiman/Strategic Selling) we know that for more complex sales processes, there are a number of buying influences in the Client organisation and they are all on their own specific purchase paths and have their own requirements that must be met. (Coach, Economic, User, Technical buying influences). In a similar way, your value proposition needs to be framed in the context of the person you are interviewing with. As an example: You are Interviewing for a senior sales position and have had a good first round interview with your prospective boss - The National Head of Sales. They now want you to Interview with his boss the Regional Sales Director. A lot of your messaging will obviously be the same but what are some of the issues that this person faces that your prospective immediate boss may not? These issues may relate to the sharing of best sales practices across the region, the leveraging of client relationships from one country to another etc. How have you done this in your current role? Your next interview is with the Regional General Manager - This person will probably want to know, - How you can support the business across functions, ie, How can you strengthen the connections between the Sales department and other functional departments in the business which helps drive organisational efficiencies and profitability. This approach is not about rewriting your whole pitch, but rather letting the interviewer know that you are cognisant of the challenges that they face, and how you will be able to support them in your role- even if in a small way. Also, on the issue of cross-functional collaboration, interviews with the more senior managers of an organisation are also often through a lens of how you are able to support the objectives of the business beyond your immediate sphere of influence. We have discussed above, some of the areas that are directly within the scope of a Salesperson's remit that can help you demonstrate your collaborative approach; you should however also use these opportunities to shine a light on your soft/non-technical skills. In his article "Soft skills are too important not to be discussed" (Lou Adler, LinkedIn May 4 2020) Lou talks about the value of candidates who have a range of soft skills. He uses the example of a candidate whose consistent election to a number of organisational committees in their present and past companies would indicate someone having the strongest of non-technical skills. What similar things have you done/experienced that could demonstrate your added value, particularly in these subsequent round interviews? Martin Dennett Principal Fifth Executive About Fifth Executive Fifth Executive is a boutique Sales Talent Development Agency that specialises in finding and growing Sales talent for organisations involved in B2B sales. We have over 50 years combined Sales and Sales Management experience.  We're certainly not Engineers but we do know a little high school science. We know that a fulcrum is something that allows you to get a greater output from the amount of energy put in. (Think of the triangular shape in the middle of a playground see-saw). The fulcrum allows you to lift a much greater weight on the other end of the see-saw than you otherwise would have been able to had it not been there. At Fifth Executive we very much see ourselves as the "fulcrum" in that central role between employers and candidates, providing both parties with capability through good communication, information and talent development. This blog page is designed to support those objectives by looking to provide topical and relevant information to employers and candidates alike in the area of Sales. Some articles will be written from our 50 year combined sales and sales team management experience, others will be from published authors that we think have the hit the mark on a topic, and from time to time we will be interviewing subject matter experts from HR Managers, to Sales Coaches to successful candidates on a range of Sales related issues. Okay, science lesson over and back to the business of Sales! Martin and Graeme. |

The FulcrumA hub for essential ideas and information, providing leverage and support to sales professionals and those that are hiring them. Archives

March 2024

Categories |

|

©

Fifth Executive

Sales Recruitment Specialists I Executive Search I Finding Top Sales Talent I Sales Recruiting by Sales Professionals.

Vertical Divider

|

Vertical Divider

|

Fifth Executive

5/20 Bond St Sydney 2000 14/333 Collins St Melbourne 3000 9/307 Queen St Brisbane 4000 Tel: 1300 33 65 74 |

RSS Feed

RSS Feed